Send money to Thailand faster, and for less.

Download our app to send money to Thailand in minutes.

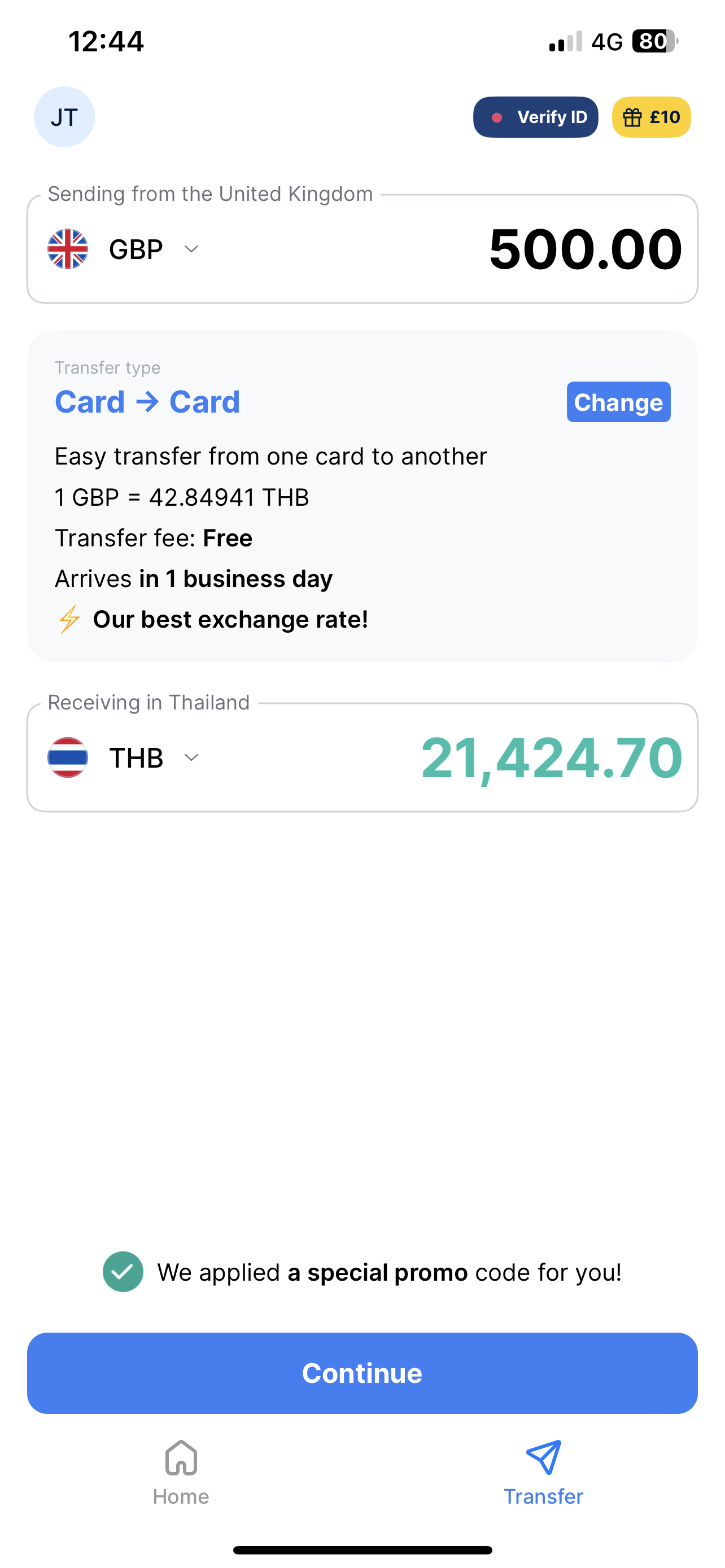

Send from

Exchange Rate

– – –

GBP 1 = NGN 2030.28232

Transfer Fee

Free – – – 0.99 0.99 USD

Receiver gets

Delivered in minutes

Rated — Excellent

From reviews on Trustpilot

How does your money arrive in Thailand?

Bank account

We transfer money directly from our bank account in Thailand to the receiver’s one, so there are no high international transfer fees.

Debit or credit card

Or we can transfer money to Thailand from the UK directly to your recipient’s bank card.

It’s as easy as 1, 2, 3

1

Choose how much you want to send, and when

Send GBP to THB or USD in Thailand

2

Add the recipient’s details

All you need is your receiver’s full name, and their card or bank deposit details

3

Choose your payment method—and make the transfer!

Pay in by card or bank transfer, and your transfer is on its way!

Rest assured

Here’s why you can trust us with sending your money to Thailand

Don’t take our word for it…

Cheaper real-time transfers to Thailand from the UK

Pay family, friends and bills back home—whichever way you suits you best.

How to get started…

What information do I need to make money transfers to Thailand?

How long does it take to send money to Thailand from the UK?

Our fastest delivery times option is instant, which usually arrives in 2-3 minutes. You can also make a transfer the next day, but your first 2 instant money transfers to Thailand are free right now—so why wait?

Best ways to send money to Thailand from the UK

Bank transfer

Bank transfers are a popular option for funding your international money transfer from the UK to Thailand. They take a little longer than debit or credit card transfers but they’re insanely cheap.

Debit card

If you want to transfer money from your country to Thailand with a debit card, it’ll make your Thailand money transfer super-fast. However, compared to a bank transfer, debit card transfers to Thailand can be more expensive as they’re charged at a higher (but still low) fee.

Credit card

You can also send money to Thailand using credit cards. TransferGo accepts both Visa and Mastercard to make credit card transfers to Thailand super-simple.

PISP

Some money transfers are enabled by a third-party financial entity called Payment Initiation Service Providers (Thailand), or PISP, which facilitates direct bank transfers for seamless online transactions.

SWIFT

When funds are processed, payment institutions use Society for Worldwide Interbank Financial Telecommunication (aka SWIFT transfers to Thailand), a global messaging network that secures and executes cross-border wire transfers and transactions.

Apple Pay

If Apple Pay is enabled on your phone, you can use your mobile wallet to send money to Thailand with Apple Pay. It’s quick and easy but check with your bank first in case they charge you extra fees. TransferGo doesn’t offer Apple Pay Thailand transfers at the moment—but we’re planning to.

Google Pay

You can also send money to Thailand with Google Pay if mobile wallet is set up on your Android. All you need is your receiver’s mobile number. Google Pay transfers to Thailand is not one of our money transfer methods to Thailand at the moment—but watch this space.

Frequently asked questions (FAQs)

How to send money to Thailand from the UK

The best and easiest way to send money to Thailand and many other destination countries around the world is through online money transfer services to Thailand from the UK.

TransferGo is a free-to-download mobile app (available for iOS, Android and Huawei from the App Store, Google Play and Huawei Gallery) that allows you to make secure online money transfers to Thailand at a favourable rate and without any fees, and it stands out for its excellent customer service in many different languages including English, Lithuanian and Polish.

All of this, plus top-notch security, affordable prices and the ability to manage your tracking transfers to Thailand, make TransferGo one of the best and most reliable companies for money transfers.

How to send money to Thailand from the UK

If you’re sending from a credit/debit card, you just use the TransferGo app to send money to a card or bank account in Thailand. Choose the currency you’re sending from and to, your receiver’s full name and card details, and then your own details.

If you’re making a bank transfer, start your order in the TransferGo app, then use your own banking app to send TransferGo the money—using the bank details they send you. Once you’ve done that, let us know in the app, and we’ll send the money to your receiver in Thailand.

What are the cheapest money transfers to Thailand?

Sending money to Thailand with TransferGo is one of the cheapest ways to send money to Thailand from the UK.

The cost to send money to Thailand with TransferGo depends on your chosen transfer method. Bank transfers are usually the cheapest money transfers to Thailand but they can take a little longer. Meanwhile, card transfers are instant but come with a slightly higher (but still very low) transfer fee.

What is the maximum amount you can transfer to Thailand?

At the moment, the maximum international money transfer to Thailand amount is around EUR 2,500 (or equivalent). This applies to both weekend days and business days.

There are no restrictions on when you can send amounts of money with TransferGo—transfers with the app are 24/7. Your money must be sent from one of our ‘send’ countries—so the UK, all countries in the EU, Liechtenstein, Monaco, Norway, San Marino and Turkey.

How to transfer money with low fees to Thailand

Curious about the cost of international money transfers to Thailand? Don’t forget, your first two transfers to Thailand are free!

After that, TransferGo uses a transparent, modular pricing structure based on the speed of the transfer and the currency corridor. We use a fair exchange rate, add a fee (where applicable) and show you the total cost.

All of our pricing is clearly displayed before you confirm the transfer so there are no hidden charges or nasty surprises. You’ll be able to see how much your recipient will get prior to confirming your transfer. It’s as simple as that.

How long it takes for your money transfer to reach Thailand

Our transfers are one of the fastest ways to send money to Thailand! But the exact transfer time of our quick money transfers to Thailand from the UK depends on your transfer delivery method.

Bank to bank transfers take a little longer than card transfers but they’re generally more cost-effective. Meanwhile, card transfers usually arrive within a few minutes but you’ll have to pay a higher (but still very low) fee for this. No matter which delivery time method you choose, we’ll make sure your money arrives on time and you’re getting the most competitive price on the market.

Will I get the best THB money exchange rate?

Foreign currency exchange rates change all the time. This applies to all currencies including Thai Baht (THB), Euros (EUR), US Dollar (USD) and British pounds (GBP).

But when you send GBP to Thai Baht to Thailand using TransferGo, you can rest assured that we’ll always try to offer great exchange rates for sending money to Thailand.

What are the advantages of sending money to Thailand with TransferGo?

TransferGo offers secure money transfers to Thailand from the UK, as well as many other countries around the world. Not only are your first two transfers completely free, but we also maintain low fees for all subsequent transfers.

As well as providing cost-effective methods for sending money to Thailand from the UK, we offer a variety of different payout methods including card and bank. We also send money to Thailand from the UK quickly and securely, with your money reaching your recipient in as little as 2-3 minutes max.

TransferGo is also available at any time of day—even at night—because our application works 24/7. We transfer money from the UK to Thailand with the best rates and we provide top-notch, multilingual customer support, which you can contact via messenger, email or phone number.

How your receiver gets the money in Thailand

We can send your money to your recipient in Thailand with two payout options: straight to their card or straight to their bank via SWIFT.

Simply choose the method that suits you and your recipient best and we’ll take care of the rest. It’s as simple as that.

Can I send money to Thailand with a bank?

Yes, you can, but it’s cheaper to use TransferGo—even if you’re sending from your bank account. Why? Because with TransferGo, your money doesn’t actually cross borders. You make a bank transfer to our account in the UK, and TransferGo pays your receiver from their account in Thailand. This can save up to 90% on traditional bank transfer fees.

With TransferGo you can also send money from one card straight to another in Thailand, and it’s almost instant. The functionality is extremely intuitive and allows you to complete transfers in under a minute.

What is the safe way to send money to Thailand online?

Online money transfers are safe, as long as:

1) You use safe and protected money transfer providers like TransferGo. Established money transfer companies are regulated by EU and UK laws, and use the highest possible security to keep your money safe. If transfers ever do get cancelled, they’ll return your money to you immediately.

2) You only send money to people you know and trust. Once your money has been sent to someone, no one can get it back. So beware of fraudsters and be sure of who you’re sending money to.

With TransferGo, you can rest assured that your money is safe when making a transfer to Thailand. We use end-to-end encryption to protect your money and your data. Should a remittance ever fail, your money gets returned straight back to you.

Which money transfer companies to trust?

Look for well established brands that have proper websites, terms and conditions, and tens of thousands of Trustpilot reviews. For example, TransferGo has over 35,000 verified reviews and a total score of 4.7 out of 5 on Trustpilot, which lets you know that the company is legitimate.

How to track the status of money transfers to Thailand

With TransferGo, you can track your money all the way until it reaches your recipient card or bank account number.

We’ll show you every step of the process, from the money reaching our account to the money reaching theirs. You can also share a link with your receiver to let them know when their TransferGo payments are on their way.