Send money to Senegal from the UK faster, and for less.

Download our app to send money to Senegal in minutes.

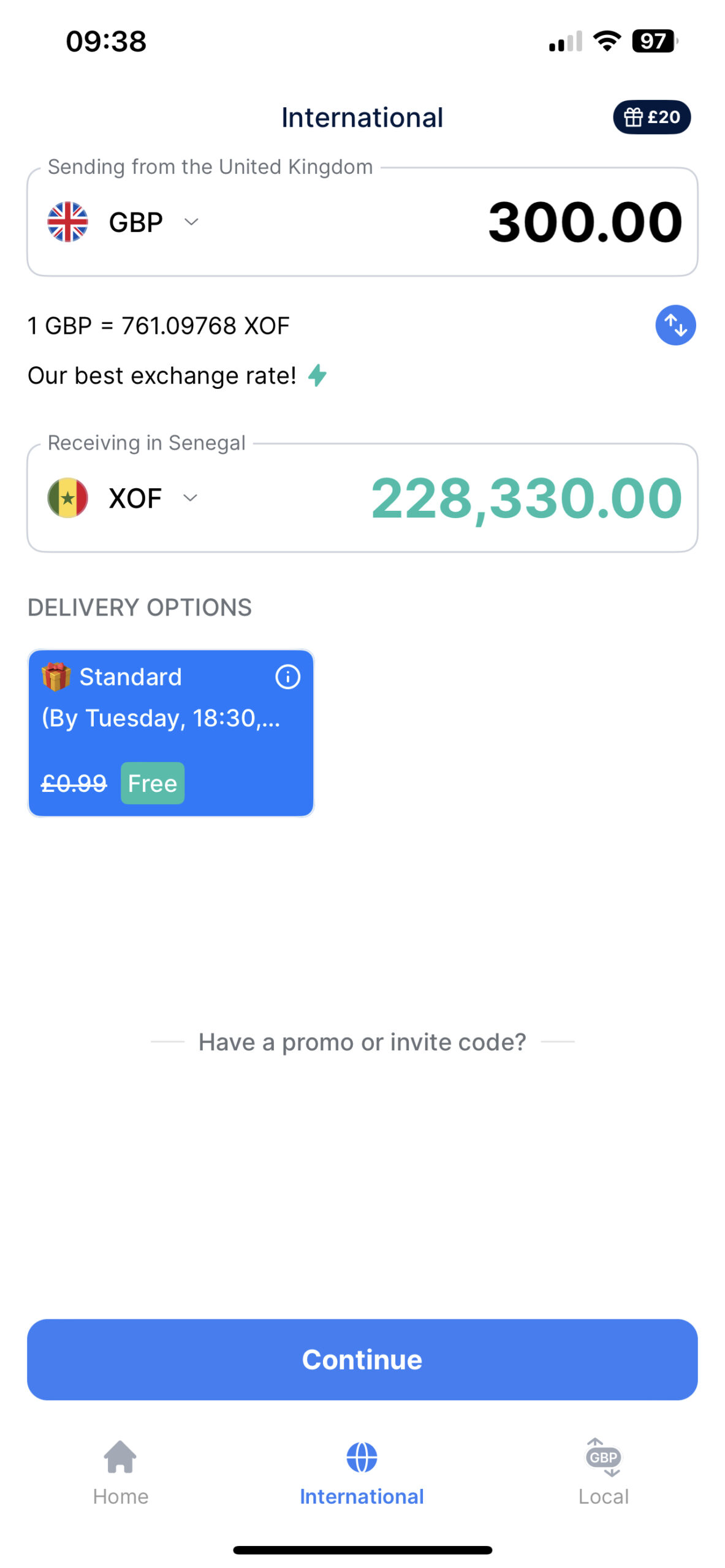

Send from

Exchange Rate

– – –

GBP 1 = NGN 2030.28232

Transfer Fee

Free – – – 0.99 0.99 USD

Receiver gets

Delivered in minutes

Rated — Excellent

From reviews on Trustpilot

How will my money transfer arrive in Senegal?

Bank account

We transfer money directly from our bank account in Senegal to the receiver’s one, so there are no high international transfer fees.

Credit card or debit card

Or we can transfer money directly to your recipient’s bank card.

Mobile wallet

We can also top-up your receiver’s mobile wallet with XOF—we just need their mobile number.

It’s as easy as 1, 2, 3

1

Choose how much you want to send, and when

Send GBP to XOF in Senegal

2

Add the recipient’s details

All you need is your receiver’s full name, and their card details

3

Choose your payment method— and make the transfer!

Pay in by bank transfer, and your transfer is on its way!

Rest assured

Here’s why you can trust us with sending your money to Senegal

Don’t take our word for it…

Cheaper real-time transfers to Senegal from the UK

Pay family, friends and bills back home—whichever way you suits you best.

How to get started…

What information do I need to make money transfers to Senegal?

How long will my money transfer to Senegal take?

Our ‘Standard’ delivery option gets your money there the next day.

Best ways to send money to Senegal from the UK

Bank transfer

Bank transfers are a popular option for funding your international money transfer. They take a little longer than debit or credit card transfers but they’re insanely cheap.

Debit card

Paying with a debit card makes your money transfer super-fast. However, compared to a bank transfer, it can be more expensive as they’re charged at a higher (but still low) fee.

Credit card

You can also pay for your international money transfers with a credit card. TransferGo accepts both Visa and Mastercard to make transfers super-simple.

PISP

Some money transfers are enabled by a third-party financial entity called Payment Initiation Service Provider, or PISP, which facilitates direct bank transfers for seamless online transactions.

SWIFT

When funds are processed, payment institutions use Society for Worldwide Interbank Financial Telecommunication (aka SWIFT), a global messaging network that secures and executes cross-border transactions.

Apple Pay

If Apple Pay is enabled on your phone, you can use your mobile wallet to send money to certain countries. It’s quick and easy but check with your bank first in case they charge you extra fees. TransferGo doesn’t offer this functionality at the moment—but we’re planning to.

Google Pay

You can also send money to certain countries using Google Pay if mobile wallet is set up on your Android. All you need is your receiver’s mobile number. This isn’t a functionality TransferGo offers at the moment—but watch this space.

Frequently asked questions

What are the best ways to send money to Senegal from the UK?

The best and easiest way to send money to Senegal and many other countries around the world is through mobile app money transfer services. TransferGo is a free-to-download app that allows you to make online money transfers at a favourable rate and without any fees, and it stands out for its excellent customer service in English and French.

What is the best GBP to XOF rate to Senegal?

Currency exchange rates change all the time. At TransferGo we always try to offer the best rates and pricing, and when the rates are especially good for any currency (including XOF and British pounds), we let you know.

How do I send money to Senegal from the UK?

If you’re sending from a credit/debit card including Visa, you just use the TransferGo app to send money to a card or bank account number in Senegal. Choose the currency you’re sending from and to, your receiver’s full name and card details, and then your own details and additional information.

If you’re making a bank transfer, start your order in the TransferGo app, then use your own banking app to send TransferGo the money—using the bank deposit details they send you. Once you’ve done that, let TransferGo know in the app, and they’ll send the money to your receiver in Senegal.

How much does a money transfer to Senegal cost?

Your first two international money transfers to Senegal are free using our Standard delivery time option. After that, we keep the fees low. We also don’t charge commission.

How can I send money to a bank account in Senegal?

To send money to a bank account in Senegal, start your order in the TransferGo app. Then, use your own banking app to transfer the money across to TransferGo with your receiver’s bank details. Confirm in the app once you’ve done this and we’ll payout the money to your recipient in Senegal. It’s that simple!

How do I send money to a mobile wallet?

You can send money to your receiver’s mobile wallet in Senegal using TransferGo. All you need to do is enter the appropriate details when you make the transfer.

Are there any restrictions on sending money to Senegal?

There are no restrictions on when you can send amounts of money with TransferGo—transfers with the app are 24/7. Your money must be sent from one of our ‘send’ countries—so that’s the UK, all countries in the EU, Liechtenstein, Monaco, Norway, San Marino and Turkey. There are some limits on the size of each transfer (see below).

At the moment, it’s not possible to make transfers from the USA using TransferGo. We also don’t offer services using agent locations or pickup locations and we currently don’t offer money transfers to West African CFA francs.

What are the transaction limits for sending money to Senegal?

At the moment, the most you can send to Senegal is around USD 2,500 (or equivalent). This applies to both weekend days and business days.

Are there any money transfer apps that work in Senegal?

It’s not possible to use the TransferGo money transfer app in Senegal at the moment.

Will you get the best XOF exchange rate?

When you send money to Senegal using TransferGo, you can rest assured that we’ll always try to offer the best XOF exchange rate.