Send money to Kenya faster, and for less.

Download our app to send money to Kenya in minutes.

Send from

Exchange Rate

– – –

GBP 1 = NGN 2030.28232

Transfer Fee

Free – – – 0.99 0.99 USD

Receiver gets

Delivered in minutes

Rated — Excellent

From reviews on Trustpilot

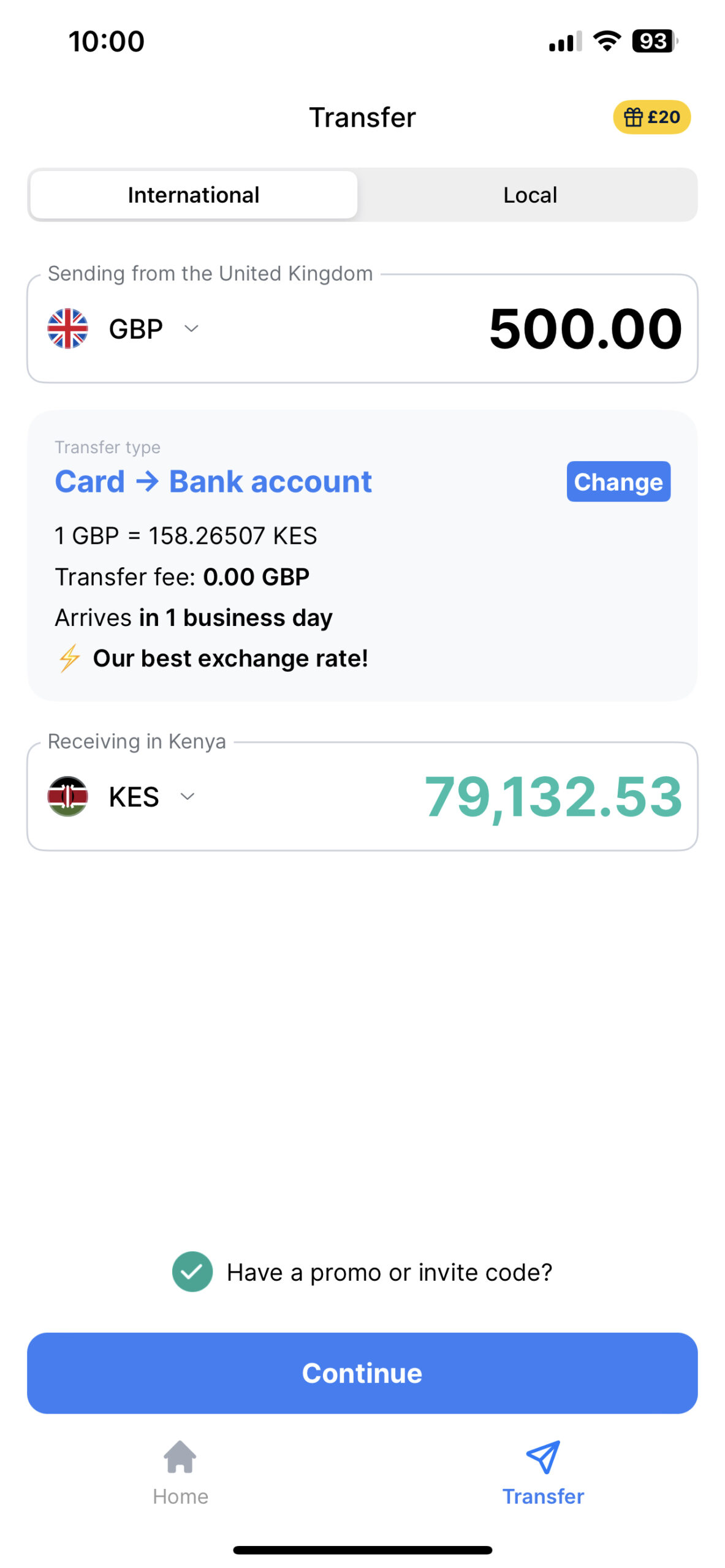

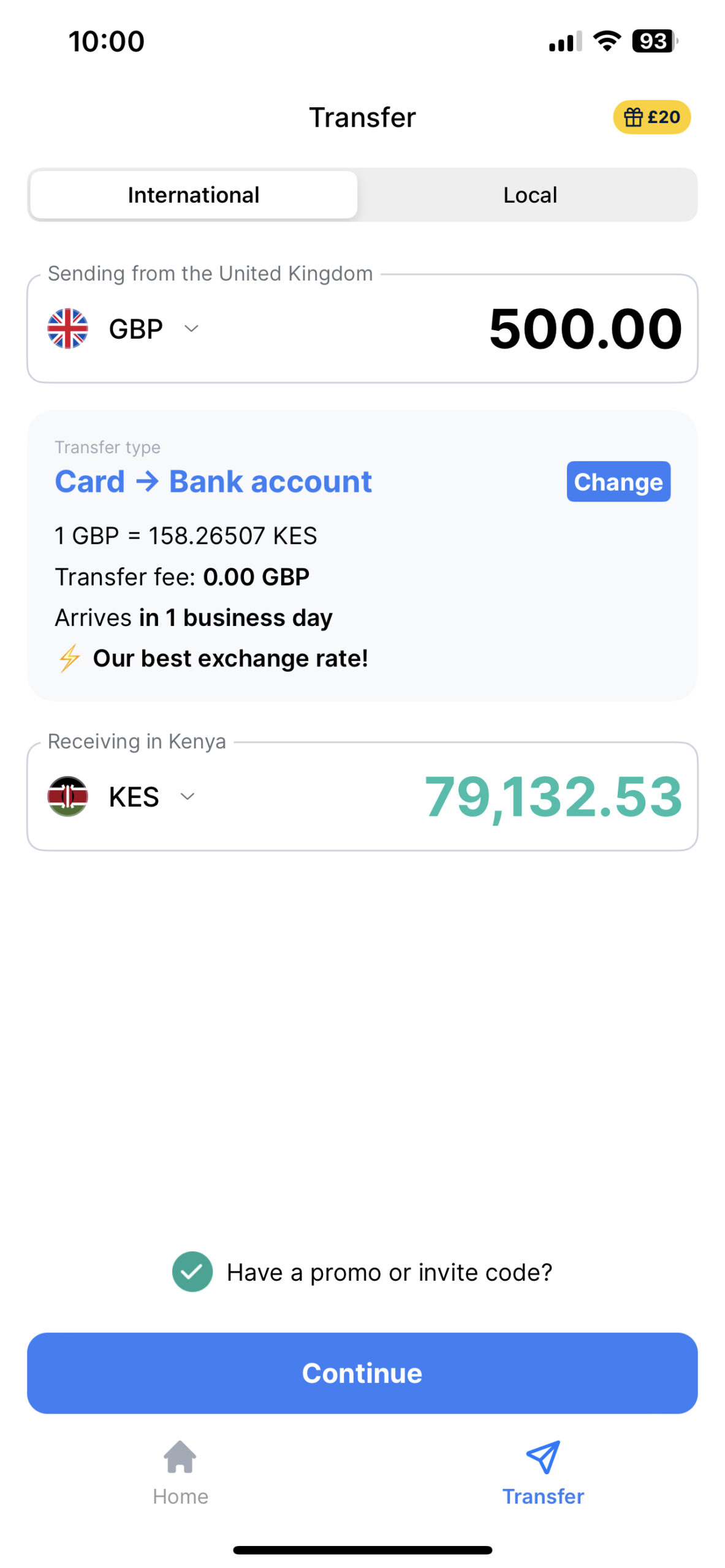

Here’s how much it costs to make a money transfer to Kenya from the UK

Your first 2 transfers to Kenya are free! After that, the fees for transferring money from UK to Kenya stay low. The receiver gets the exact amount that our app tells you. No hidden fees, no nasty surprises.

Download the TransferGo app:

How does your money arrive in Kenya from the UK?

Credit card or debit card

We can transfer money directly to your receiver’s bank card so there are no high international transfer fees for transferring money from UK to Kenya.

Bank transfer

We can also send money to Kenya via bank transfer. It’s a little slower but it’s one of the cheapest money transfer methods UK to Kenya.

It’s as easy as 1, 2, 3

1

Choose how much you want to send, and when

Send GBP to KES or USD in Kenya

2

Add the recipient’s account details

All you need is your receiver’s full name, and their card or bank deposit details

3

Choose one of our payment methods—and make the transfer!

Pay your money in, and your transfer is on its way!

Rest assured

Here’s why you can trust us with sending your money to Kenya

Don’t take our word for it…

Cheaper real-time transfers to Kenya from the UK

Pay family, friends and bills back home—whichever way you suits you best.

How to get started…

What information do I need to make money transfers to Kenya?

How long does it take to send money to Kenya from the UK?

How long to send money from UK to Kenya? Our fastest transfer time from UK to Kenya is instant, which usually arrives in 30 minutes! You can also make a transfer the next day, but your first 2 instant online money remittances to Kenya are free right now—so why wait?

Best ways to send money to Kenya from the UK

Bank transfer

Bank transfers from UK to Kenya are a popular option for funding your international money transfer. Sending money to Kenya from UK via bank transfer takes a little longer than debit or credit card transfers but it’s insanely cheap.

Debit card

Debit card transfers from UK to Kenya make your money transfer super-fast. However, compared to a bank transfer, using debit card for Kenya transfers from UK can be more expensive as they’re charged at a higher (but still low) fee.

Credit card

You can also pay for your international online money transfers with a credit card payment from UK to Kenya. TransferGo accepts both Visa and Mastercard so you can send money to Kenya using credit cards from UK easily.

PISP

Some money wire transfers are enabled by a third-party financial entity called Payment Initiation Service Provider Kenya, or PISP. PISP transfers from UK to Kenya facilitate direct bank transfers for seamless money online transactions.

SWIFT

Curious about SWIFT transfers from UK to Kenya? When funds are processed, payment institutions use Society for Worldwide Interbank Financial Telecommunication (aka SWIFT), a global messaging network that secures and executes SWIFT code Kenya cross-border transactions.

Apple Pay

If Apple Pay is enabled on your phone, you can use your mobile app wallet to send money to Kenya from UK with Apple Pay. It’s quick and easy but check with your bank first in case they charge you extra pricing fees. TransferGo doesn’t offer Apple Pay Kenya transfers at the moment—but we’re planning to.

Google Pay

You can also send money to Kenya with Google Pay from UK if mobile wallet is set up on your Android. All you need is your receiver’s mobile phone number. Google Pay transfers from UK to Kenya isn’t a top up functionality TransferGo offers at the moment—but watch this space.

Frequently asked questions (FAQs)

What is the best way to send money to Kenya online?

Real-time money transfer services are the fastest, easiest way to send money to Kenya (or any destination country around the world). Most of them are free to download, and are up to 90% cheaper than banks and other financial services, service providers and payment services. Some apps, like TransferGo, have outstanding Customer Service in several languages for when users need support with anything from payment options to payout options.

What are the top apps for sending money to Kenya from the UK?

Wondering what the best app to send money to Kenya from the UK is? With a rating of ‘Excellent’ from over 35,000 reviews on Trustpilot, the TransferGo app is highly recommended by users around the world. You can download it for iOS, Android and Huawei from the App Store, Google Play and Huawei Gallery.

How long does it take to send money to Kenya from the UK?

Sending money with TransferGo is one the fastest ways to send money to Kenya from the UK. The delivery times depend on which delivery method you choose.

If you choose ‘Instant’, the money will arrive in under 30 minutes—usually, the transfer time is 2 or 3 minutes max. If you choose ‘Standard’, the money will arrive within one working day.

What are the best ways to send money to Kenya from the UK?

Sending money to Kenya from the UK is easy with TransferGo. All you need to do is sign up, open our app, choose how much you want to send and when and pay. Then, your transfer will be on its way!

With TransferGo, you can send money to credit cards, debit cards and bank accounts in Kenya from the UK.

How much can I send to mobile money accounts in Kenya?

At the moment, it’s not possible to send money to a mobile wallet account in Kenya using TransferGo. But watch this space.

However, you can send mobile money online to Kenya using your mobile phone and the TransferGo app. At the moment, you can send money to credit cards, debit cards and bank accounts in Kenya with TransferGo.

How do exchange rates impact sending money from the UK to Kenya?

Currency exchange rates for UK to Kenya change all the time but we always try to offer the best exchange rate for sending money from UK to Kenya to make your money transfers as low-cost as possible. This applies to all currencies including Kenyan Shilling and GBP.

As well as providing the best rate to send money to Kenya from the UK, we also offer great exchange rates to all other destination countries.

What fees are associated with sending money to Kenya from the UK?

Your two first money transfers to Kenya with TransferGo are free! (Regardless of whether you make your transfer on weekends or business days). After that, we charge low fees.

Bank transfers are typically our cheapest option. They involve sending money from a bank account number to another bank account number. Although the fees are lower, the transfers tend to take a little longer. Instant transfers are quicker and are ideal for when you need to send money urgently. However, they come with higher fees (which are still really low).

At TransferGo, we’re always transparent with our pricing and offer great exchange rates. No hidden additional fees, no nasty surprises.

How to send money from London to Kenya using a bank transfer?

Yes! You can send money from London to Kenya using a bank transfer with TransferGo. Simply open our app, choose how much you want to send and when, add your recipient’s details including their full name and bank details and pay. Then, your transfer will be on its way!

How can I send money to a bank account in Kenya from the UK?

Wondering how to send money to a bank account in Kenya from the UK? It’s easy with TransferGo! If you’re sending from a credit/debit card, just use the TransferGo app to send money to Kenya bank accounts. Choose the currency you’re sending from and to, your receiver’s full name and card details, and then your own details.

If you’re making a bank transfer, start your order in the TransferGo app, then use your own banking app to send TransferGo the money—using the bank details they send you. Once you’ve done that, let TransferGo know in the app, and we’ll send the money to your receiver in Kenya.

How to send money from UK to Kenya through Mpesa?

M-Pesa is a mobile phone-based money transfer service that allows users to store and transfer money through their mobile phones.

As M-Pesa is a completely separate brand from TransferGo, send money from UK to Kenya Mpesa is not a service we can help with or provide advice about.

What is the cheapest way to send money to Kenya from the UK?

Compared with other digital money transfer apps, TransferGo is one of the cheapest ways to send money online to Kenya from the UK and always has favourable currency exchange rates. As well as being one of the best send money to Kenya apps, we also offer fast and friendly Customer Support in 10 languages, which gives you peace of mind when you need it.

Are there any limits on how much money I can send to Kenya through online services?

At the moment, the highest transfer amount you can send to Kenya is around USD 2,500 (or equivalent).

There are no restrictions on when you can send money with TransferGo—transfers with the app are 24/7. Your money must be sent from one of our ‘send’ countries—so from the United Kingdom, all countries in the EU, Liechtenstein, Monaco, Norway and San Marino. There are some limits on the size of each transfer (please see above).