Go further with our global business account

Ready to reimagine the way you handle international payments? Send, receive and manage money from around the world—all from a single, simple-to-use, multi-currency business account.

One account. A world of possibilities.

Whether you’re a sole trader, run a multinational operation or manage an ambitious scale-up, our business account is tailored to streamline cash flow and save you time and money.

Keep expenses down with zero setup fees or subscriptions

Hold and exchange multiple currencies; maximise efficiency and profit with local and global account details

Call upon a team of experts for personalised help, should you ever need it

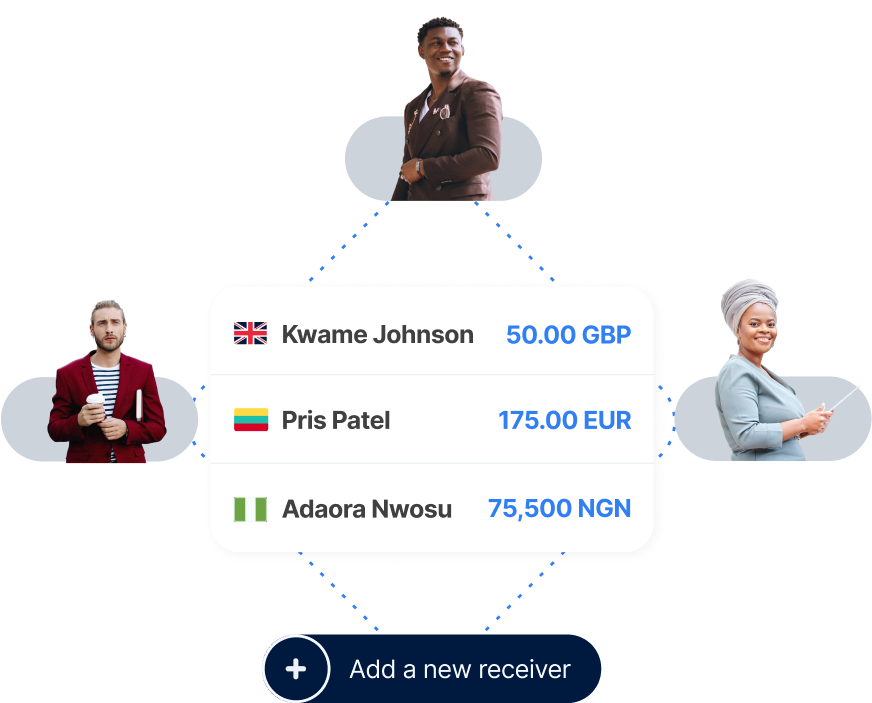

Local convenience, global reach

Featuring an IBAN and local account number, our business account gives you the best of both worlds—whether you receive payments from international clients, pay employees both locally and abroad, move money between subsidiaries or work with multiple suppliers around the world.

- Transparent pricing with no hidden fees

- Zero fees on major routes, with transfer margins as low as 0.35%

- 97%+ faster-than-promised delivery rate

Currency management, made easy

Dealing with multiple countries can get complicated—that’s why our service consolidates all your currencies and transactions into one account for greater clarity and control.

You can hold balances in GBP, EUR, RON, PLN and more and maximise your value by locking in industry-leading rates. You can also send and receive payments directly from your balance, in whichever currency gives you the best value.

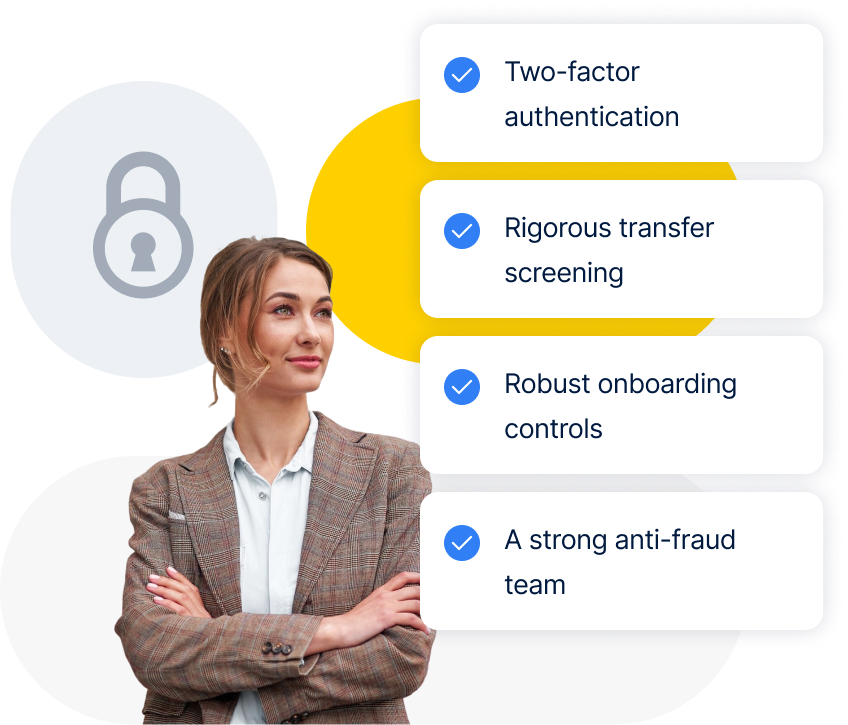

State-of-the-art security for your business

TransferGo’s high-grade security protocols keep your funds safe and guarantee you peace of mind, every step of the way. We also comply with all regulatory requirements, meaning each transfer is safeguarded until payout.

And if you ever have questions, our all-star support agents are on hand, ready to tailor their expertise to your business’s specific needs.

What do other business owners think?

Our network of global businesses is always growing. Discover how operations like yours are benefitting from TransferGo’s international payment solutions.

“Simple, reliable and reassuring.”

Evaldas, MV Pirmas Pasirinkimas

“Timely and transparent.”

Irma, Directors Lab

“Low fees, fast transactions and a user-friendly interface.”

Raimonda, Nomi Fame

Frequently asked questions

What is a multi-currency business account?

A multi-currency business account is an account that holds several different currencies. You can use this account to simplify your international payments by making transactions in the currency of your choice.

You can also capitalise on favourable foreign exchange rates by converting the currencies held in your account.

Are there fees for international payments with a TransferGo multi-currency business account?

There are no fees on major transfer routes, and our exchange-rate markups are as low as 0.35%.

Any applicable fees are always significantly lower than those charged by major banks or PayPal—in fact, you stand to save up to 9x more on money transfers simply by using a TransferGo multi-currency business account.

How does TransferGo’s multi-currency business account help with international payments?

Unlike traditional cross-border payments, we employ a local-in, local-out method. This is a secure, speedy way of getting money from A to B without the need for costly intermediaries.

And because the TransferGo multi-currency business account can hold multiple currencies and facilitates a variety of payment methods, it’s easy to pay whoever you want, however you want.

We also work with reputable, reliable payment partners. So, no matter which transfer method you choose, you know your payments will arrive as quickly as possible.

How does TransferGo’s multi-currency business account help with foreign exchange rates?

We always try to offer you the best exchange rates. Using mid-market rates for our currency conversions, we apply a small margin on the exchange rate to cover our operational costs.

Whenever you make an international payment, we always show you the conversion rate upfront before you finalise your transfer.

Is my money secure with TransferGo?

TransferGo Business is completely safe and secure. We’re FCA regulated, meaning your money is safeguarded until payout. And, in the rare event a transfer doesn’t go through, a full refund is guaranteed through our trusted partners.

Other state-of-the-art security measures include: a strong anti-fraud team; robust onboarding controls; two-factor authentication and rigorous transfer screening.

What kind of support does TransferGo provide for international business accounts?

We go above and beyond to ensure the business owners that partner with us get the personalised, face-to-face treatment they deserve.

That’s why when you register for a business account, we assign you an expert to help you with any sign-up issues. We also have a team of support agents at hand, should you ever need to get in touch.