TransferGo Currency Converter

Check live foreign currency exchange rates here.

Currency Converter

Amount

Convert to

1 GBP = GBP

Mid-market exchange rate at 00:00

Looking to make an international money transfer? You can count on TransferGo!

Don’t just take our word for it…

Here’s what our users say about sending money home with TransferGo

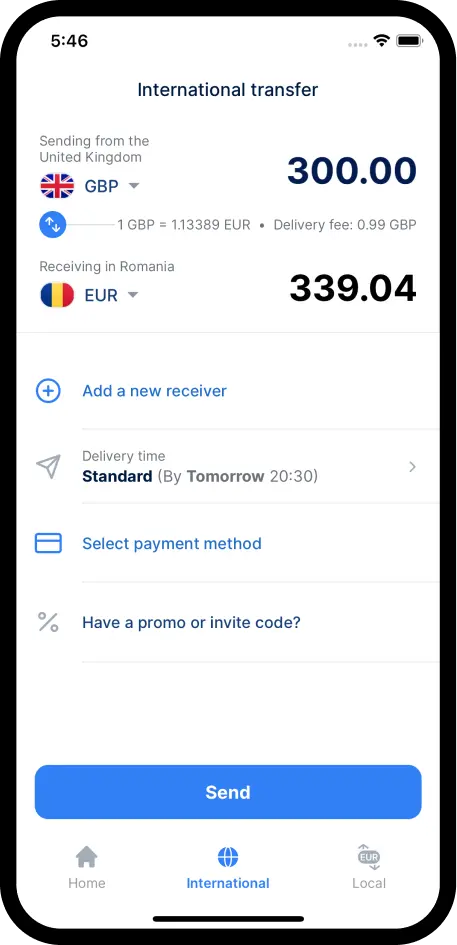

How to convert foreign currencies with TransferGo

1. Choose the amount and currency

Send money to over 160 countries around the world

2. Add the receiver’s details

You can send money using cards, bank accounts and payment links

3. Pay for the transfer

… and your money will be on its way!

How does the currency converter work?

Our currency converter tool allows you to convert hundreds of currency pairs fast. All you need to do is select your currencies, input the amount and click ‘Convert’ and we’ll show you how much your money is worth based on live foreign currency exchange rates. We’ll then use this real exchange rate when you send money abroad using TransferGo.

What is TransferGo?

TransferGo is the easy way to send money around the world in just a few minutes.

Founded in 2012, TransferGo serves over 8 million customers in more than 160 countries worldwide. Our aim is to provide more accessible financial services to migrants, making international money transfers cheaper, simpler and faster.

Guides and Resources

How to send money

Learn how TransferGo simplifies personal money transfers and business payments with fast, secure, and affordable services.

About TransferGo

Everything you need to know about the company that sends your money home.

Resources & Articles

From help with sending and saving money to travel guides, career advice and stories from around the world.

Frequently Asked Questions

What is a currency converter?

A currency converter is a tool that allows you to see live market exchange rates. At the click of a button, you can convert one currency to another, making it easier for people and businesses to exchange money between different currencies.

Exchange rates change all the time but TransferGo’s currency converter uses real-time exchange rates so you can keep your eye on any given currency. You don’t even need to be signed up with us; simply select your currencies and amount and our currency converter will display the amounts based on the latest market values.

What’s the difference between the market rate and the customer rate?

Also known as the interbank rate, the market rate is the exchange rate that banks, financial institutions and large corporations use to trade currencies on the global market. Typically, this rate is very close to the real-time market value of a currency pair and is usually not available to individuals or small businesses. These currency exchanges are usually traded in large amounts with short-term loan periods.

Meanwhile, the customer rate (or retail rate) is the rate that customers or businesses get when they exchange money through a service provider such as a bank, currency exchange service or online platform. Since it includes a markup (a transaction fee, commission or profit margin), the customer rate varies on the service provider and is usually less favourable than the market rate.

What currency conversion rates does TransferGo use?

Here at TransferGo, we always try to offer you the best exchange rates. We use mid-market rates for our currency conversions, applying a small markup (or margin) on the exchange rate to cover our operational costs. We’re known for our transparency when it comes to rates and fees; we’ll always show you the conversion rate upfront before you finalise your transfer.

What are floating and fixed exchange rates?

Floating exchange rates and fixed exchange rates are two different systems for determining a currency’s value in the foreign exchange market.

Most countries (including the United States, Eurozone and United Kingdom) use a floating exchange rate, which is when a currency’s value is determined by market forces such as supply and demand. This exchange rate fluctuates freely based on various factors such as interest rates, inflation, economic growth, political stability and speculation and market sentiment.

Meanwhile, a fixed exchange rate (also known as a pegged exchange rate) is a system where the value of a currency is set and maintained at a specific value against an internationally popular currency like the US Dollar or Euro. This allows the country’s government to buy and sell currency as required to maintain the exchange rate within a narrow band. Countries that use fixed exchange rates include Hong Kong, Denmark and Saudi Arabia.

Where to get the best exchange rate?

The best exchange rates are those which are as close to the interbank rate as possible. This means that you’re getting the most favourable rates for converting one currency into another, with minimal additional costs like fees, commissions and profit margins set by the currency exchange provider.

To determine whether you’re getting a favourable exchange rate, you can look up the current interbank rate via a search engine to get a good idea of which providers are offering the best exchange rates. Here at TransferGo, we’re known for our great exchange rates and complete transparency around our rates and fees. What you see is what you pay.

How do I send my money at a good rate?

Sending money at a good rate means you’re getting the best exchange rate possible. When you spot a favourable market exchange rate when using TransferGo’s currency converter tool, simply log in to your account and you can send a transfer at the same rate.

You can rest assured that our competitive customer rates are often much better than those offered by typical banks—in fact, you can save up to 90% when you send money with TransferGo! Our dedicated customer support representatives are also on hand whenever you need help with your transfer. They’re good that way.